Once every four years, politics and finance converge as the American public elects a President. How will the election results affect the stock market? Investors speculate what the outcome may mean for their portfolios. While the uncertainty may feel overwhelming, a look back at history may ease our concerns of what to expect in the months ahead.

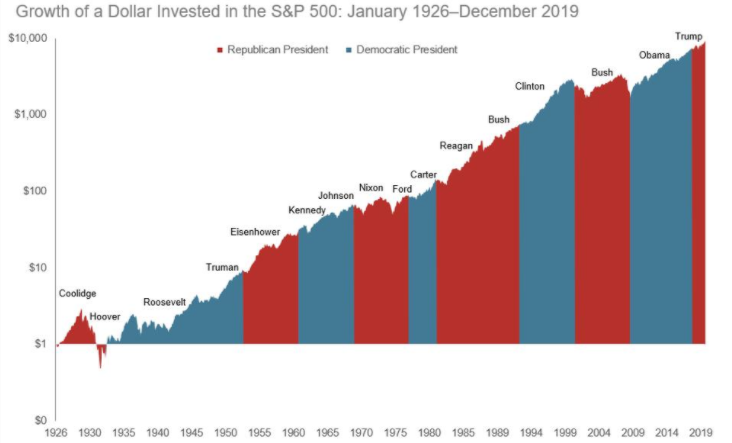

First, there is one trend that is consistent throughout history. In general, markets rise over time regardless of what President Elect or party is in the White House. As seen in the chart below, markets generally rise whether a Republican or Democrat is in office. While policy changes can certainly have an impact on the economy, markets, and returns, we generally see positive returns.

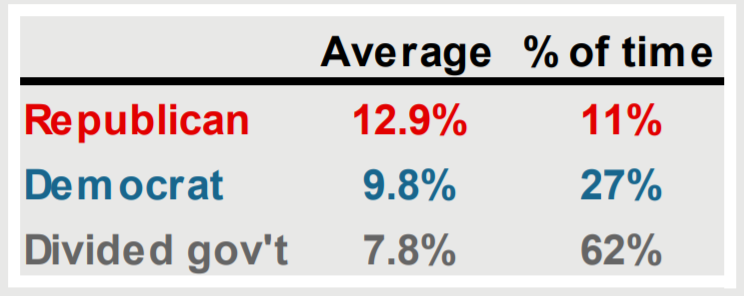

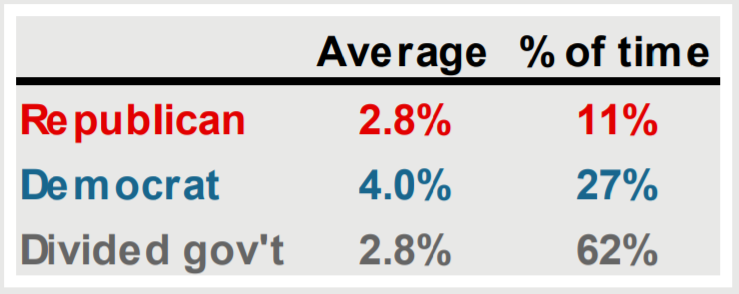

Further, the following is a breakdown of the average S&P 500 return and GDP growth since 1947. Both charts below outline average results for when Republicans control the White House and Congress, when Democrats control both, and when each party controls one of the two.

The charts above suggest that investors have yielded good returns under either political party, whether one party has a majority in Congress or whether we have a divided government. Will election results affect stock market returns? While politics and policy certainly play a definitive role in financial markets, U.S. businesses and investment managers have proven they are resilient and adaptable to the changes that inevitably occur every year.

Further evidence suggests that it is best to stay the course, resist the urge to make emotional decisions, and invest steadily as opposed to trying to time the market. Staying invested through market uncertainty leads to superior long-term results.