We have all seen ABC’s game show Who Wants to Be a Millionaire. The show was a huge success because of the thrill of watching one person navigate the opportunity to win $1,000,000 in one night by correctly answering trivia type questions. The reality for most of us is that we will never become a millionaire overnight.

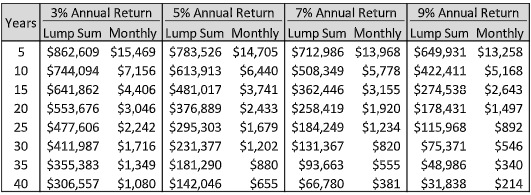

That said, if you want to become a millionaire, what do you need to do to get there? The answer depends on how many years away from your goal you are, and what rate of return you are expecting. Answering the former question is easier than the latter, but we can make reasonable assumptions. The chart below outlines how much you need to save in either a lump sum or in monthly installments to get to the $1,000,000 mark.

As an example, if you have 25 years until retirement, and are expecting a 7% return, you either need to invest $184,249 on day one (lump sum), or invest $1,234 per month for the next 25 years. As you can see, the earlier you start, the less you need to save to arrive at a balance of $1,000,000.

While there is no way to predict exactly what your return will be, you can use this chart as a starting point. If future returns are lower than you expected, you will need to increase your savings to bridge the return gap. If your estimate of returns was too conservative, you may become a millionaire earlier than you expected.

Is a million dollars the right amount for you? It depends on your goals and objectives, and what you are looking to accomplish with the assets you accumulate. If you are unsure what number you should target, or what rate of return you should assume, we can help. Call us and we would be happy to assist you in navigating your financial plan and getting you on the right track to achieve your future goals.